Stockry list (

[0] => vnt

[1] => Dbi

[2] => Dbi

[3] => APA

[4] => Ssm

[5] => nxt

[6] => GMG)

The story features Ventia Services Group Limited, and other companies.

Share Analysis for More Information: VNT

The company includes ASX200, ASX300 and all the orders

Service -powered infrastructure is renewing how Australians build flexible departments.

Paul Songs will be

For investors, the Australian infrastructure market now feels like a building site and feels like a subscription business.

Today, these are the contracts that run money. Investors are cutting these stable cash flow into bonds, securities and private credit deals.

In other words, you own a rent roll, not a building.

Your leader for Infrais Asce Cash Floose:

-infra-AAS Model is mirror in power and communication in the service of the 1920s.

-Broker’s prediction highlights repeated revenue from data centers, cloud bilateral contacts and digital utilities

-Pur Funds see rapid infra-AA as a defensive output exposure with the ability to develop

-First ASX Tech Infra firms can gain competitive advantage as regulatory guard rails are tightened

Echo of the 1920s: How do the past infrastructure revolutions hold today’s infra -boom mirror

Does the infra feel strangely familiar? Well, the reason for this is that there is a poetry in history.

Think back in the 1920s. Power grids, telephone exchange, and radio towers were running fast. After that, investors were not just buying in static assets, they were effectively writing new service models.

A light bulb itself was not valuable. It became valuable once when houses paid for a monthly current, which kept it shining. Calls crossed in copper wire make less than repeated fees.

Infrais is not so different today. Think about data centers, digital connectivity centers, and smart -meter energy systems. They once produce cash flow through the electrical lines and switchboards.

We are talking about a stable, contract, and demand for long -term services.

The mechanics of property may have moved, but the basic story is the same. Investors are in a position around the necessary services that society cannot be closed.

Why Infrais is important

Infra-AAS is not a marketing spin. This is a different cash flow profile:

As for, as.Forecast’s income: For decades, pay revenue related to long -tech or salary or availability contract line.

As for, as.Operational focus: Return assets are obtained by maintaining (services) instead of making assets (caps).

As for, as.The severity of the lower capital: The risk of a lower front balance sheet; It is easy to measure through contracts.

As for, as.Defensive tilt: Service revenue is often more downturn than collective exposed assets.

Straight Sadies: Infra-AAS provides you with infrastructure style production, which reduces heavy risks.

Large institutions have reinforced the idea that infra-AAS is important.

In Australia’s private market projects and its infrastructure book, growth is often referred to as the driver of the domestic contract flow and allocation.

Analysts have increased the fund to allocate its target to the private market infrastructure, reflecting a billions of opportunities.

Brookfield Block Sale DealemPal Bay Infrastructure (DBI)) – Almost Almost 527M – Some people did not have stock for fear.

Instead, it improved the liquidity and re -upgraded the broker and upgraded. It has been indicated that a large amount of money looks at the cost of contracting, long life cash flow.

ASX InfraSS Shortlist

The following is a compact table showing the key ASX name, infra AAS angle, recent broker/market signal and significant investment/endangered route.

We predicted broker calls, consensus price goals and growth from market sources so that you could see the dissertation and numbers.

A-Inde-AAS-Part 1

A -infra -aas -2

Walk Throw – What do these numbers mean

As for, as.Dealerimal Bay Infrastructure (DBI)) is a clean case study in which market service -style cash flow is starting. This year, Brock Field sold about $ 1 billion worth of stocks. Nevertheless, the extra liquidity actually attracted more buyers. Both Brokers Morgans and the RBC hit their price goals at $ 4S after the dust was resolved.

Run Number: FY 26 division guidance is 24.5 cents per share. At the cost of $ 4.30 shares, it is about 5.7 % forward production. For many entities, this profile looks less like a coal -linked asset and like the bond proxy listed with the equity rating cooker.

Of course, it’s still a coal terminal, and ESG screens just don’t end – but you can see why the production hunters are circling.

As for, as.APA Group ((APA)): Brokers’ mid -$ 8S price targets and vinegar 6 % of production reflects a reliable contracted cash flow company, but also appears at the speed of energy transfer. For flexible income sleeves, the APA still gains a place as a stabilizer, but this is not a high growth story. Treat the APA as a gut, not a high clause leg.

As for, as.Ventia services ((VNT)): 7 2.7bn Defense Agreement is such a multi -year -old, government -backed tax that rewards institutional investors. Brokers (McKori) are taking flags to the re -rating ability.

Unanimously priced targets at mid -$ 5s indicate a modest period of the recent period, and the EPS Growth predictions show a viable story.

If you believe that demand for long government services contracts will remain intact, Ventia is a direct infra-AAS game without Capex.

As for, as.Service Stream ((SSM)): This textbook is Asset Light Infra-AAS Chen: Rehabilitation and Network Services, Repeated Contract Cash Flow, and 6 1.6-1.7bn Catalists after the contract announcements.

Brokers have eliminated the goals (Macorie’s 70 2.70 is an example) and the consensus price goals average $ 2.6, which means that with the contract, it has a 10 % upside -down plus growth.

Routine warning: margin matter; If the wages or material are increasing, the service providers can feel the essence.

How to Position-A balanced infra-sleeve

Practical approach for ASX Portfolio:

As for, as.Production Foundation: DBI (revenue, inflation) + APA (pipeline stability)

As for, as.The overlays of growth and service: Ventia, Service Stream-Depending that provides revenue increases and re-rating capacity

As for, as.Satellite Beats: If you want to develop with high volatility, the Data Center or Digital Infra Exhibition (Next DC (NXT)), Goodman Group (GMG))

As for, as.Size and diligence diligence: Keep the position size managed, test tension for high rates, and review the credit quality of contract length/counterparts

This mixture reverses you in revenue in the bottom of the cycle and the contract in better times.

Dangers – don’t vaccinate them

As for, as.Regulatory and ESG pressure: The DBI exhibition for coal terminals keeps it in the politics of transfer. The decrease in the rules or the demand for sharp coal can be reduced by the volume

As for, as.Execution and cost inflation: Service providers (Venia, SSM) may be dynamic or labor shortage. See the margin closely

As for, as.The risk of financing and rate: Some vehicles still rely on length. Increasing costs of loans affect profit

As for, as.The risk of concentration: Sector or counterpart concentration (such as one major contract) means that if matters go wrong

ASX Infra-IS: The market moved, but the price remains for smart investors

Infrais is no longer theory. It is already creating a balance sheets and broker model. The pattern is quite clear.

Dealerimal Bay Infrastructure And the APA is anchor for stable income. Ventia and the service stream are operators operating with room rooms. The Next DC and the Goodman Group are a high -profile satellite riding on digital demand.

Keep it together and you have something close to a balanced sleeve: Part Bond Proxy, Part Growth Cooker. Big picture?

We are removing the service grids of the 2020s as investors once supported the construction of power in the 1920s.

The only question is whether you will be collecting cash flow – or paying them.

Technical limits

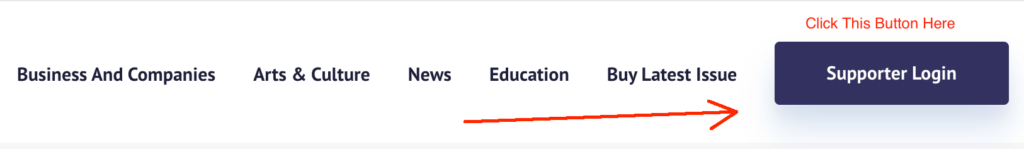

If you are reading this story through a third party distribution channel and you can’t see the included tablesFor, for, for,. We apologize, but to blame the technical boundaries.

Find out why Fnarena users like the service so much: “Your feedback (thank you)” – Warning contains shamelessly positive opinions on the service provided in this story.

Finarina is proud of her track record and past achievements: ten years

To share this story on social media platforms, click on the symbols below.

Click to view our financial terms dictionary