Even before introducing temporary import duty on Chinese electric cars in the European Union, European carmakers were concerned that China would react to retaliation. These concerns now appear to be true, as China is potentially targeting foreign carmakers with import duty on combustion vehicles.

As announced on Friday, the Chinese Ministry of Commerce has consulted with experts and representatives from industries and sectors to collect opinions and suggestions about increasing taxes on large engine combustion cars. The ministry did not comment on the results of the participants or the meeting.

In May, the Chinese Chamber of Commerce in Brussels had already warned of possible response measures against the forthcoming European extra Levies. According to insiders, the affected vehicles may be subject to 25 % tariff.

The Chamber said at the time, the move would “affect European and American carmakers, especially in light of recent recent developments.” In Europe, German and Italian carmakers will be particularly affected, as their vehicles fall into the ‘big combustion engine’ class. It includes BMW, Mercedes -Benz, Vox Wagon (ETR 🙂 (mainly at home, Audi, Lamburgeni and Bugti), Porsche (ETR :), Ferrari (NYSE 🙂 and Stellasts (mainly alpha Romeo, Messera, Ibrat, Ibrah, Ibrah, Ibrah, Ambat, Ibrah, Ibrah, Ibrah, Ibrah, Ibrah, Yes.

The end of the golden period for European car makers?

Let’s put it like: Everyone was surprised by the strength and quality of Chinese car makers and in some places. But every crisis also offers an opportunity. Especially as China’s pressure is increasing daily, European car makers can no longer rest in their own names. It will ensure more and more rapid innovation. The only problem is that there will be short -term fluctuations that will not affect employees.

Almost all stocks of the aforementioned manufacturers are still pointing to the bottom. We believe it is too early to buy this location over time. Problems are still huge and the approach to solving them – if they have enough of them – are still very new.

The following graphic car makers show direct comparisons:

Prices show profit/loss since IPO

The obvious necklace is Porsche, which is significantly down. However, the reason is that the stock is still very young and young stocks always do the same thing: they get up shortly and then fall below the price price, and then the journey continues. We note that BMW and Ferrari are still a clear winner.

Although the reforms have not yet ended for most of the work makers, we should no longer make the mistake of losing European car makers. We already know that reforms will pass, and even when and where there are the most likely areas for a permanent change.

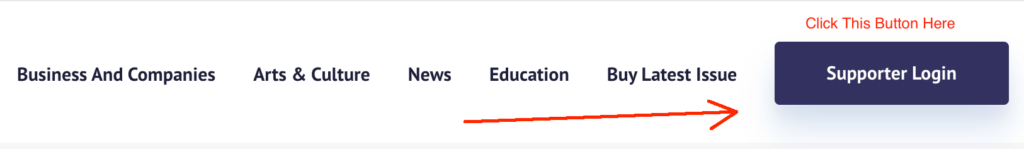

Daily car manufacturers (and of course from other fields to other fields) analysis can be found on our website in the customer area. And since confidence is good, but testing is even better, you should not give up the opportunity to test our professional package. You can do this for the entire 14 days full of free and without any responsibility. Click the link above this text with my profile picture.

And how are the politicians reacting to the risk from China?

The United States has already imposed high sanctions on Chinese electric cars. However, in the European Union, it is not yet clear whether similar measures will take place. The European Commission will have to make a decision, which will be voted for 27 EU member states. The final explanation is expected by the end of October.

China has strongly criticized the European Union of its actions, and accused the Union of ignoring the interests of protectionism and European consumers, among other things. At the same time, China is checking the EU imported goods as part of the anti -subsidy investigation, including spirits, pork and some dairy products. In doing so, China is putting strategic pressure on European governments.

Hundreds of investors trust us every day, read our reviews, follow our recommendations, and consequently make their wealth permanently preparing. Our performance itself speaks itself: Since 2016, our portfolio has not received less than 20 % return every year. Coincidentally, this is equivalent to us such as soros, buffet and bronze. To go to us: Click the link above this text with my profile picture.

Dispute/Risk Warning:

The information provided here is only for informational purposes and do not recommend buying or selling. This should not be considered as a clear or clear assurance of a particular price development of the aforementioned financial equipment. The purchase of securities includes risks that can lead to a complete loss of investment investment. The information provided does not replace expert investment advice according to individual requirements. To any responsibility or guarantee, either clearly or clearly, timely, accuracy, appropriateness or information provided, nor any financial losses. Supposedly. These are not clearly financial reviews, but journalistic texts. Readers who make or make investment decisions based on the information provided here completely make their risk. The authors can conduct securities of companies/securities/shares discussed at the time of publication, and therefore there may be a dispute of interest.