BXB Shares in Focus

Brameables manage the world’s largest pond re -enclosure, crate and containers, providing a service in most supply chains globally.

The company is more famous by its central brand CHP, which includes operations in the Asia Pacific, the United States, and Europe Middle East and Africa (EMEA).

Brameables make money through rented models. For example, a manufacturer will create a product, then transfer the product to a retailer on the cheap palette. After that, these pallets are transferred back to another manufacturer or retailer in the CHEP or the supply chain. At every step, brimbles collect daily fare fees on their palets and crates.

Key measurement

If you have ever tried to read a company’s income statement on the annual report, you will know that it can be very complicated. Although there are numerous figures to draw you from this statement, there are three key The tax, the gross marginAnd Profit.

Income is important for clear reasons – everything starts here. If you can’t receive revenue, you cannot make a profit. The thing we are worried about is not so absolute number, but rather Bent. BXB reported the annual income of 6,744m last time, with one Compound Annual growth rate (CAGR) In the last 3 years of 7.6 % each year.

By moving the income statement down, then we reach the overall margin. The overall margin tells us how profitable the basic products/services are – before you keep the overhead cost, how much does the company make money from selling $ 100 worth of goods or services? BXB’s latest reported overall margin was 34.5 %.

Finally, we have a profit, it is the most important personality. In the last financial year, Brimbles Limited reported a profit of 80 780m. This is compared to 3 years ago when he made a profit of 3 523m, which represents a CAGR of 14.3 %.

The financial health of BXB shares

The next thing we need to consider is the company’s capital ‘health’. What we are trying to evaluate here is whether they are creating a reasonable return to their equity (total value of total shareholders) and they have a decent protective buffer. A scale we can see is Net debt. This is just the company’s total loan of cash holdings. In the case of BXB, the current net debt is sitting at $ 2,528m.

Here a high number means that a company has a lot of debt, which means high sensitivity to high interest payments, high volatility, and high sensitivity to interest rates. On the other hand, a negative price shows that the company has more cash than a loan (a useful protective buffer).

However, the argument is more important than Loan/Aquatic percentage. It tells us how much the company’s share is owned by the owners. In other words, how much is the company benefiting? The BXB loan/equity ratio is 81.8 %, which means they have more than debt.

Finally, we can see Back to Equity (ROE). The ROE tells us how much profit the company is making as a percentage of its total equity – the high number shows that the company is allocating capital well and generating a price, while a small number shows that if they pay a profit to shareholders as a profit. BXB developed a ROE of 25.6 % in fiscal year 24.

What to make BXB shares?

https://www.youtube.com/watch?v=qpuru-blkdc

The BXB has a solid ROE and the profit is moving upwards, so it can be a company capable of adding your ASX share price watch list. However, the increase in revenue has decreased.

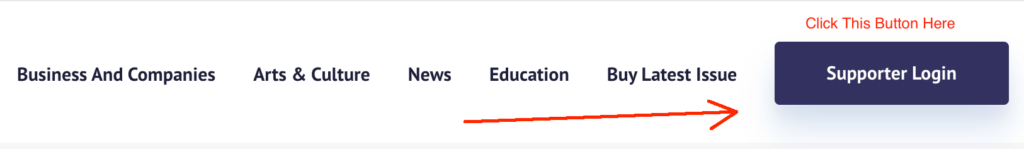

Please keep in mind that these figures are important but only your research should start. It is important to get good grip on the company’s financial affairs and compare it to his colleagues. It is also important to ensure that the company’s price is fair. More information about shares price price you can sign up for one of our many free online investment courses.